Analyzing fitness brand spend data to show how the industry is changing

Consumer spend data is reshaping how brands understand the fitness industry. By following where dollars are flowing, companies can uncover surprising demographic shifts, competitive dynamics, and growth opportunities that can be applied to any brands expansion strategy.

The gym industry is filled with different models, price ranges, and service offerings, making the category highly competitive. Credit card spend data makes it easy to see how consumer preferences and spending patterns at fitness centers are shifting in some pretty big ways,. Some challenger brands are gaining ground in regions where the biggest players have long dominated, while others are finding ways to compete on more than just price.

It’s not just the fitness industry where spend data is uncovering hidden opportunities. It’s also showing where revenue is flowing and which demographic groups are driving it across categories.

We’ve analyzed data from over 150 million credit and debit cards, representing nearly $1 Trillion in transactions to uncover the shifts and patterns in the gym industry. This article explores what spend data tells us about which gyms are winning share, how customer demographics are changing, and where the next big growth opportunities are hiding. Brands in any space can use this same process to recognize shifts and make better site selection and market analysis decisions.

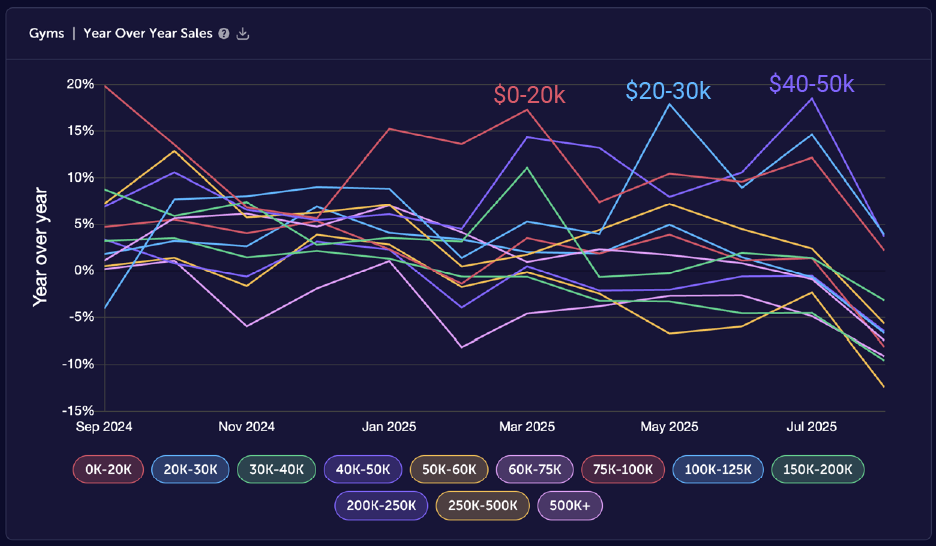

The surprising rise of low-income consumers

For years, the upper-middle class represented the backbone of the fitness industry. But spend data shows that the fastest growth is now coming from households earning less than $50,000 annually. In fact, the only income range showing positive year-over-year sales growth fall below that threshold. This is especially striking because it includes not only budget gyms but also premium options like Orangetheory, which is seeing significant sales growth among lower-income households alongside more affordable brands like EOS Fitness and Crunch.

This shift challenges assumptions about who drives growth in the fitness category and beyond. It suggests that price sensitivity does not necessarily limit consumer willingness to spend if the value proposition resonates. For brands, the takeaway is clear: new opportunities can emerge from audiences that may seem unlikely at first glance. Uncovering and adapting to these shifts early can lead to untapped growth.

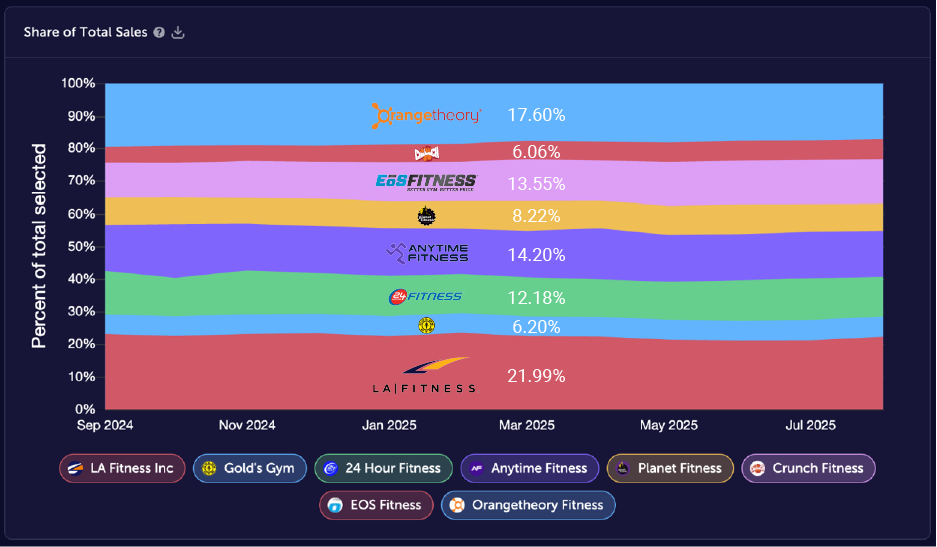

Market share doesn’t always mean revenue share

Membership numbers alone don’t tell a gym’s full story. While Planet Fitness commands the largest number of gyms and members in the U.S., it isn’t the leader when it comes to revenue share. Brands like LA Fitness, Orangetheory, Anytime Fitness, and Crunch capture a larger portion of consumer dollars despite having a fraction of the members.

The lesson here applies across industries: success isn’t just about volume. A brand with fewer buyers can outperform a competitor with a larger base if its customers are more valuable. Understanding how much your customers are willing to pay — and why — is critical. Spend data reveals this difference and gives companies the clarity to adjust strategies, whether that means enhancing value, rethinking pricing, or focusing on deeper engagement with high-value segments.

Paving a path for challenger brands to take lead

Spend data also reveals how smaller players can rise quickly against established leaders. Within the value gym category, EOS Fitness is a clear example. Although its overall market share is smaller than Crunch or Planet Fitness, EOS is growing rapidly, especially among low-income consumers in the Southwest and West. Its trajectory shows how an emerging challenger can carve out share by resonating with an overlooked audience.

The data also highlights a roadmap for how EOS could continue its rise. Expansion into the Midwest and Southeast would place it in markets where value gyms are thriving, but EOS has little presence. At the same time, targeting student and “City Hopeful” segments, groups where Planet Fitness currently leads, could accelerate its momentum.

The bigger story is this: emerging brands in any industry can use spend data to chart a path to leadership. By identifying which audiences are fueling growth, spotting whitespace regions, and understanding where competitors are vulnerable, challengers can move faster and smarter.

Why spend data matters for market planning

What makes these insights so powerful is not just what they reveal about the current state of the gym industry, but what they say about the value of spend data as a whole. Consumer spending patterns act as an early signal for change. They show who is gaining traction with new audiences, where demand is heating up geographically, and how customer value differs across brands. This is information that can guide decisions on pricing, promotions, and expansion long before traditional research would catch the shift.

For any brand, the lesson is clear: following the money gives you a clearer view of the market. By tapping into spend data, companies can uncover hidden opportunities, avoid costly missteps, and act faster than competitors.

Recommended Posts