What’s the best way to calculate sales impact? Hint: It involves tech.

How — and why — the smartest multi-unit brands use innovative technology to calculate sales impact

Sales cannibalization might be an age-old problem, but that doesn’t mean you should be stuck with age-old solutions. Real estate teams have incorporated scientific calculations into their marketing planning in the last three or four decades, but now this trend is accelerating as the technology advances.

Technological innovation has changed the way customers interact with brands. Consumers’ behavioral changes present a unique opportunity to capture new types of information for a holistic approach — but your decisions are only as strong as your data collection and analysis capabilities. With the pandemic having accelerated brands’ digital integrations, the need for a modern alternative to in-person pin studies is greater than ever.

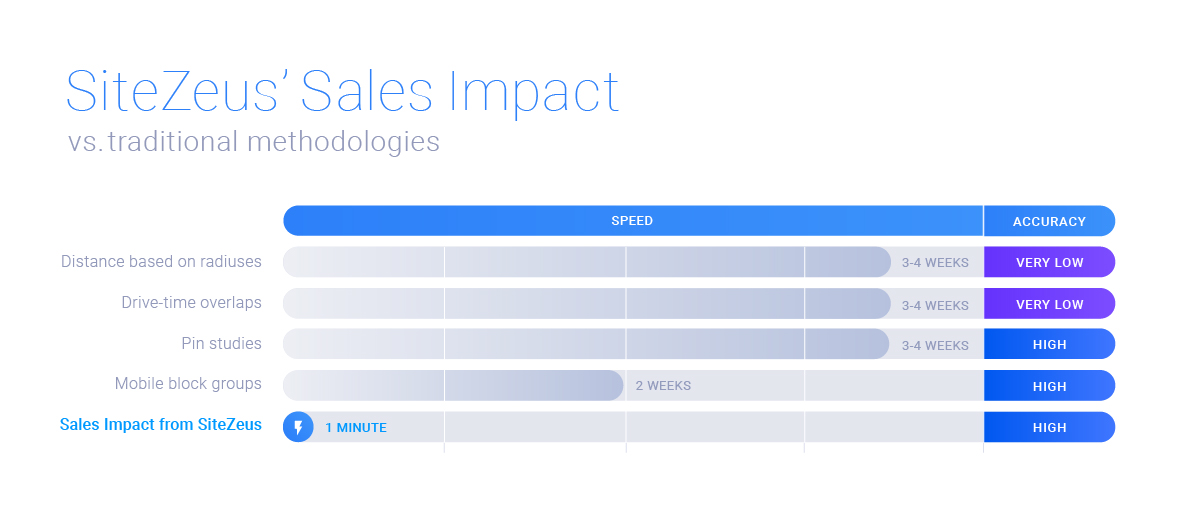

Why spend thousands of dollars and wait several weeks to receive the results of a pin study when you could get real-time analyses at the click of a button? A data-driven solution not only saves you time and money but also offers a more comprehensive view of your current and prospective markets. A.I.-powered technology puts significantly more data points at your fingertips and distills them into accurate predictions and actionable takeaways.

What sales impact studies tell you

A multi-unit brand’s real estate team might conduct a sales impact study to

- determine how opening a new site would affect sales at a nearby existing site;

- find the brand’s infill growth potential, learning where to open stores within a market to maximize profitability; and

- evaluate market saturation to proactively create fortressing strategies.

Jonathan Trapesonian, Taco Bell’s head of market insights and site selection analytics, discussed the importance of being thoughtful when planning a brand’s growth: “We want to grow in a very fiscally responsible way,” he said. “We want to make sure we’re investing in trade areas and new development that’s going to generate as much return as possible for both us and our franchisees.”

SiteZeus’ sales impact solution allows brands to be proactive in their growth strategies and “create opportunities in markets they thought were already fully penetrated,” said Greg Goddard, director of development and franchising at Penn Station.

Traditional methodologies for calculating sales impact

Here’s a look at four methods traditionally used to calculate sales impact.

- Distance-based radiuses

Strategy: This methodology uses distance to evaluate sales impact. After estimating the trade area based on the average distance customers travel to a given location, the real estate team simply draws a corresponding radius around a proposed site to visualize any overlap.Downside: While a good starting point, this strategy does not account for each trade area having a unique size and shape influenced by geographical features, roadways, and nearby attractions.

-

Drive-time overlaps

Strategy: This method calculates a site’s trade area and consequent sales impact using the average customer drive time, with the ideal drive time dependent on the type of business. For instance, a fast-service restaurant might consider a 10- to 15-minute drive time. For each site, the real estate team would draw all customer routes within this range and enclose them in a polygon. Then, to determine the sales impact of a proposed location, they would measure the overlap of the polygons.Downside: Like distance-based radiuses, this method doesn’t account for convenience or travel patterns. It also assumes customers come to your site equally from all directions. You need to know what’s actually happening on the ground to get a good picture of how it will impact sales. For example, a customer may visit one location on the weekends because it’s near their home but visit another on weekdays because it’s by their office.

-

Pin studies

Strategy: Pin studies, sometimes called encroachment studies, are the most popular of the traditional methods. They rely on third-party consultants stationed on-site to ask customers where they just came from, where they’re going next, and where they live. The surveyors then manually plot the answers onto a physical map of the area using thousands of pushpins to visualize which existing customers will find the new site more conveniently located.Downsides: A pin study catches only those customers who are both present during the survey and willing to participate in it. This gap leaves many questions unanswered and introduces bias into the calculations. Sales vary with season, day, and time — so it takes quite a while to generate a representative sample population. After spending thousands of dollars to conduct the study, you might not see its results for a month or longer. By this time, the data may no longer be relevant.

Plus, health measures such as social distancing make this in-person interaction challenging. And even when frequent interaction is possible, the nature of human involvement in the data-collection process may lead to inadvertent inaccuracies through misplaced pins and vague customer answers.

-

Mobile block groups

Strategy: Mobile data studies leverage geofencing technology and cell phone locations to calculate sales impact. Location-based geofencing consists of marking a digital “barrier” around an area on a map, then using mobile phone data to track customers as they move toward, into, and away from this area.Downside: While geofencing increases the accuracy and size of your sample population, it requires you to make assumptions about what percentage of a block group will transfer to the new location. And it still means waiting weeks to get results, with additional costs for each test scenario you run.

Sales impact analyses from SiteZeus answer your questions as quickly as you can think of them

Advances in data science and artificial intelligence (A.I.) have elevated the accuracy and value of sales impact studies to unprecedented levels.

How it works

Now that almost all customers have smartphones, mobile location datasets capture the actual travel patterns of all your customers before and after they visit your site. This precision lets your real estate team study customer behavior in a trade area with unprecedented granularity.

SiteZeus’ A.I.-powered sales impact solution is powered by mobile data from industry leader Near. We note every mobile device that entered the walls of your store in the last year, then study each trip and answer questions such as the following:

- What day and time was the trip taken?

- What is the mobile device’s common evening location (likely where the customer lives) and daytime location (likely where the customer works)?

- Where was the customer right before they visited your location?

SiteZeus’ sales impact models are trained and tested using millions of documented trips to existing and new locations over the prior three years. Retroactive tests have proven that our innovative sales impact analyses match real-life results with 95 percent accuracy, the highest in the industry.

Using a year’s worth of actual data accounts for variables such as season, day, and time and allow SiteZeus’ sales impact solution to analyze trip patterns in a way that predicts human psychology and behavior.

Leveraging mobile-based consumer-trip-pattern data really gives you a good picture of the pre- and post-trip pattern of your consumer. Where else do they dine? Where do they shop prior to arriving? It’s not only about cannibalization, but also about consumer profiling.”

Jonathan Trapesonian, Head of market insights and site selection analytics at Taco Bell

The huge amount of data feeding into SiteZeus’ sales impact solution enables real estate teams to pick better locations more quickly and confidently than before. By including all customers who have visited your site in its predictive model, SiteZeus takes the guesswork out of efficient market expansion. We help you grow consistently, without cutting into your current success.

Significantly faster — and unlimited

The A.I.-powered sales impact analysis provides results in just seconds, helping you get sites approved and operational as fast as possible without sacrificing accuracy in your decisions.

Timing is extremely important. Taking longer to get results can delay development, so the quicker we get results, the better. It benefits not only us but also the franchisees whose deals are on the line.”

Bri Gallo, strategic development analyst at Taco Bell

Plus, rather than pay for a separate pin study for each potential location, you can run unlimited scenarios on SiteZeus’ platform at no extra cost.

One platform for all your market-planning needs

With a subscription to SiteZeus, teams wanting to grow in existing markets are guaranteed a thorough market planning study. The sales impact solution is integrated seamlessly into the platform, so you can go right from running a sales forecast on a potential site to analyzing possible cannibalization, including the effect nearby competitor sites could have on your new location. Being strategic about how you choose sites will save you time and money down the line. We lay the rails so you can run full steam ahead — no U-turns needed.

Recommended Posts