What the build-your-own-bowl battle taught us about spend data analysis

This deep dive into the build-your-own-bowl space shows how spend data can expose winners, laggards, and untapped markets. These are insights any brand can apply to their own growth strategy.

The ‘build-your-own-bowl’ category, which includes QSR and fast-casual concepts like Cava, Chipotle, and Sweetgreen, has quickly become one of the most disruptive forces in QSR and fast casual dining. This segment—sometimes referred to as ‘slop bowls’—is seeing rapid shifts from emerging brands that are winning with younger, more affluent consumers. And while the bowl category offers a clear example, consumer preferences and behaviors are being reshaped across many industries.

To make sense of these shifts, it’s critical to look at the data behind them and uncover what’s really driving the change. The real insight comes when you can identify which brands, in any space, are gaining traction, which are slipping, and where your own brand’s growth can follow. By analyzing credit card spending data across brands, demographics, and regions, we can see exactly where growth is happening and why it matters for brands competing in any competitive landscape.

In this article, we will explore the ‘build-your-own-bowl’ space and which concepts are seeing the greatest success and where opportunities lie. It’s an interesting and familiar sector, but the lessons go far beyond bowls. These insights highlight how spend data can surface opportunities in any industry. In future posts, we’ll uncover what the data reveals about other concepts and categories.

Industry Trends

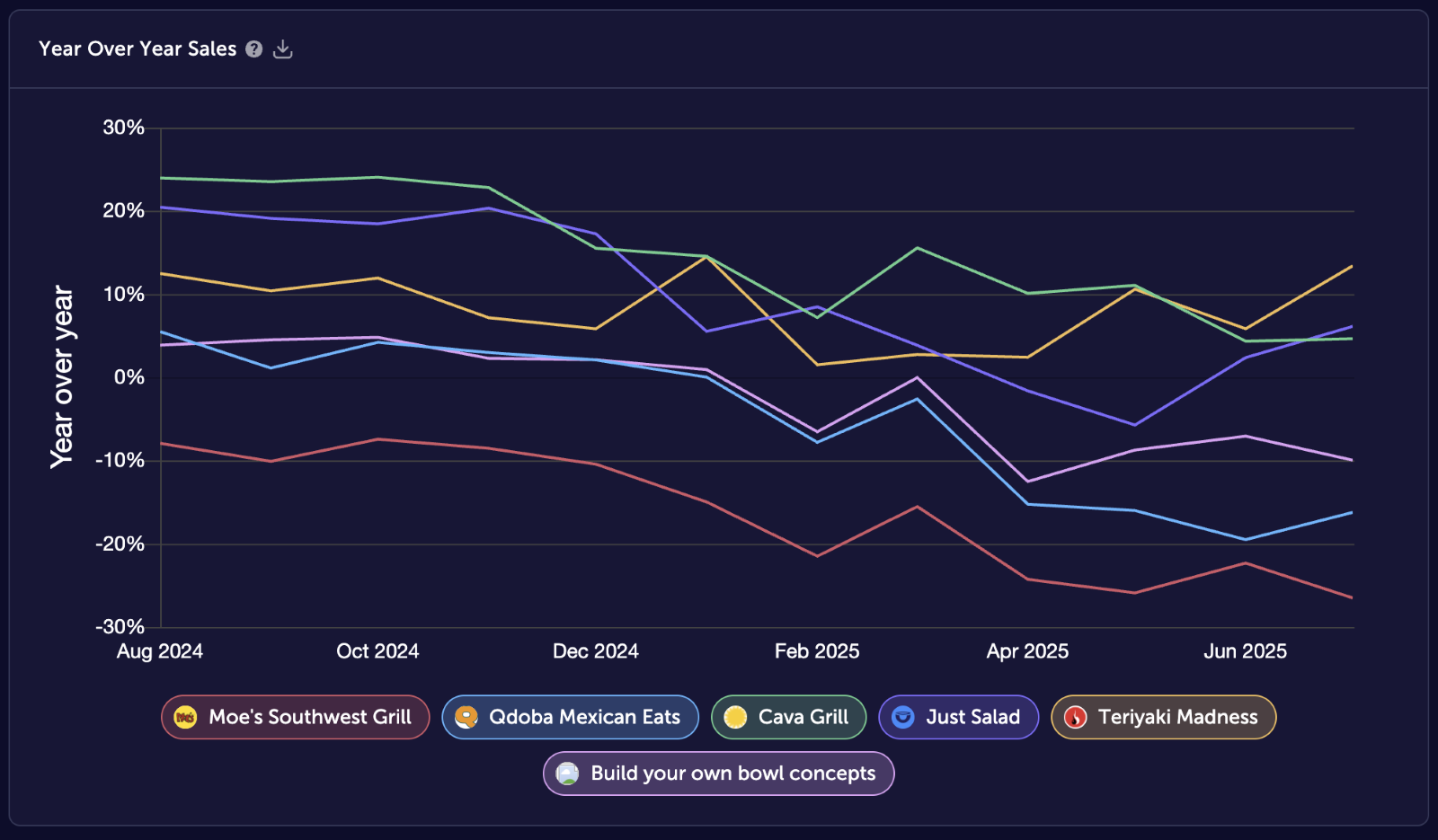

To understand the full scope of performance within the “build-your-own-bowl” category, we analyzed the last 12 months of spending data, drawn from more than 150 million credit and debit cards and representing purchase insights across over 2,000 brands. Within this dataset, we benchmarked the category using a sample of 26 bowl concepts and took a deeper dive into six key brands: Cava, Just Salad, Moe’s Southwest Grill, Qdoba Mexican Eats, and Teriyaki Madness.

At the industry level, the data tells a clear story: scale doesn’t always mean growth. Legacy players that once defined the space are starting to feel the weight of changing consumer expectations, while smaller, more agile brands are gaining traction.

What stands out is how legacy brands like Moe’s and Qdoba have both performed below the category benchmark while innovators like Cava, Teriyaki Madness, and Just Salad are outperforming the category average.

Compared to the broader QSR and fast casual industry, bowl concepts have underperformed in overall sales growth this year. Although, the western U.S. remains a notable outlier where the category continues to outpace the industry average.

Consumer insights

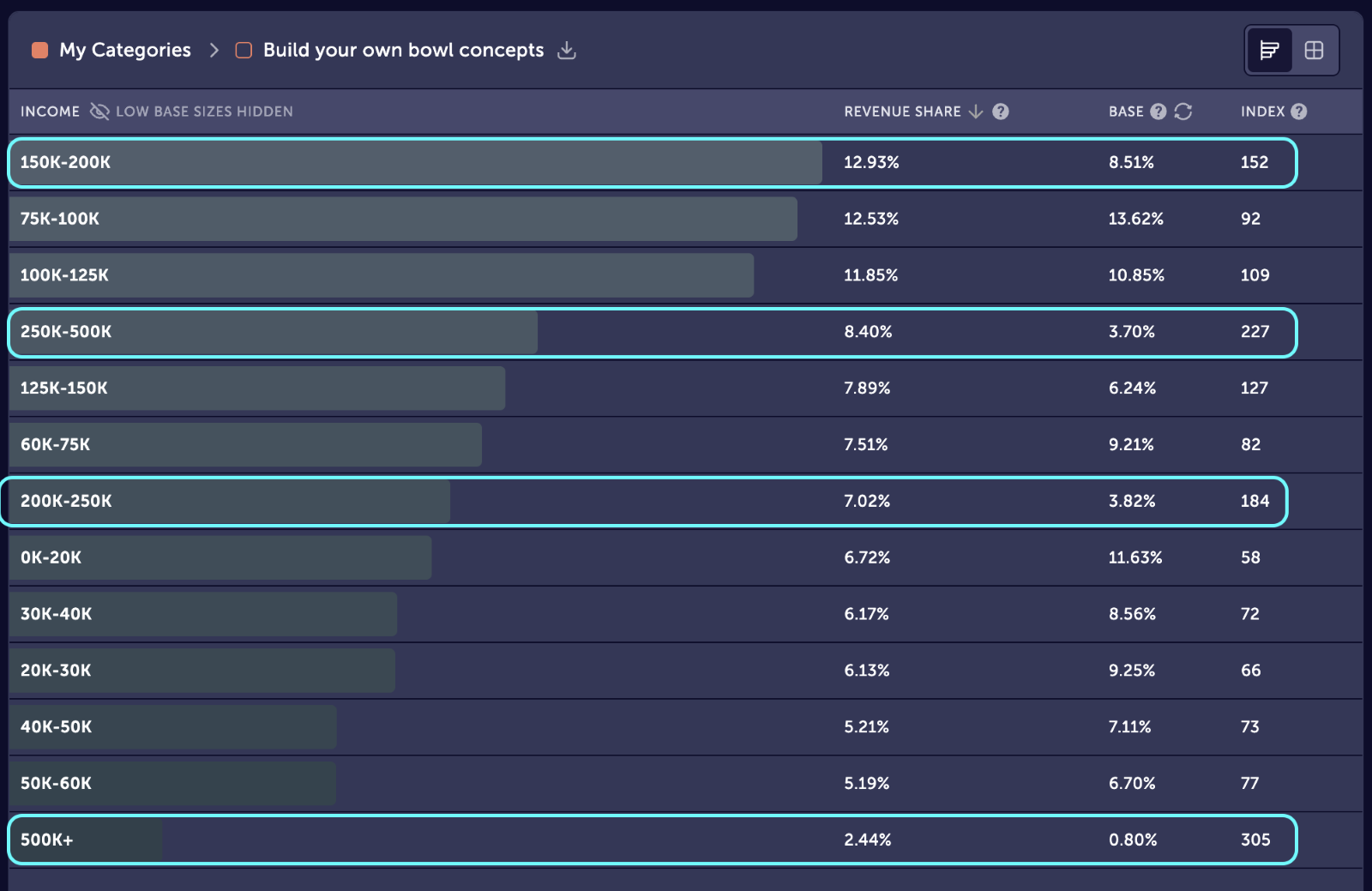

Its biggest customer base comes from higher-income households, with the majority of revenue share concentrated among families earning $150K or more annually. This reinforces the idea that bowls are positioned less as a budget-friendly option and more as a premium choice within fast casual.

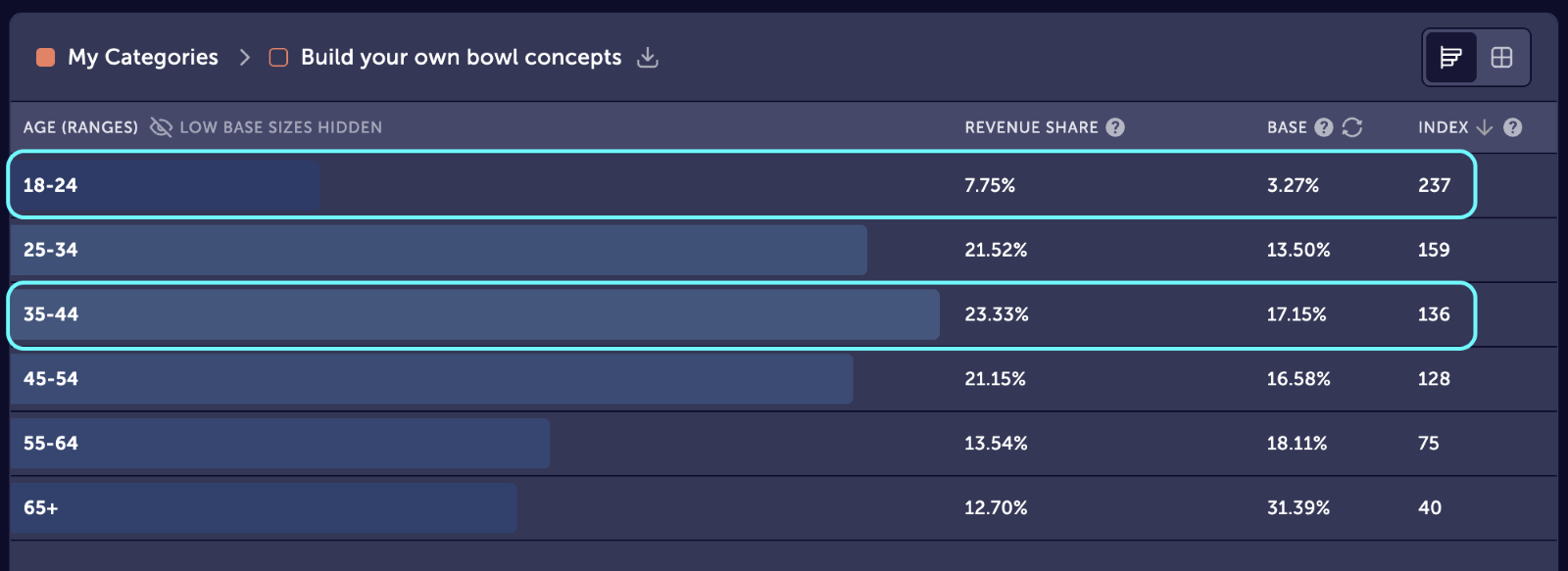

Consumers between the ages of 25 and 44 drive the largest share of spend, but it’s the 18–24 years old group that index the highest, signaling a strong opportunity among younger consumers who are shaping long-term growth. By winning over Gen Z, brands in this space can build loyalty with the generation most likely to define future dining trends.

Brand-specific insights

Qdoba: Big footprint, slipping growth

Qdoba remains the largest player in the bowl category, but scale hasn’t shielded this 30-year-old brand from shifting consumer dynamics. Sales declined more than 16% year-over-year, and while the brand is still a powerhouse in the Midwest, its dominance hasn’t translated into growth with younger or more affluent diners. To stabilize, Qdoba could either lean deeper into its loyal Midwestern core or work to win back higher-income and younger diners with fresh menu updates or targeted promotions. It may also be critical to expand more aggressively into coastal and urban regions, where competitors like Cava and Just Salad are gaining share.

Cava: The category’s breakout star

Cava is the category’s breakout story. With steady share gains across regions and a 4.7% increase in sales year-over-year, it has emerged as the most consistent growth engine among larger brands. Its strength lies in affluent suburban families and younger consumers, with strong growth on the coasts. The data points to two opportunities: continue leaning into its suburban strength while breaking into Midwest markets where Qdoba remains strong and further amplify its positioning with younger diners who are already indexing high.

Just Salad: Small but surging

Just Salad may be a small player in overall market share, but its growth trajectory tells a different story. Sales grew 6.2% year-over-year, with particularly strong gains among young professionals and in urban markets. This shows the brand resonates with a specific, upwardly mobile audience. Just Salad could extend its momentum by targeting younger demographics in secondary metro and suburban areas, where the category overall is thriving, but competition is still less intense.

Teriyaki Madness: Quiet momentum

Teriyaki Madness stands out with a 13% year-over-year sales lift, with even sharper growth among diverse suburban families and in western markets. To continue its rise, Teriyaki Madness could double down in suburban regions where bowl concepts are performing well, and build stronger awareness in income brackets where the brand is underpenetrated compared to competitors. Winning these groups could accelerate Teriyaki Madness’ climb into a more dominant share of the category.

Moe’s Southwest Grill: Fighting relevance

Moe’s is experiencing steep decline, with sales down 26.5% year-over-year. Once a strong competitor, Moe’s is losing relevance as younger consumers migrate to newer brands. Moe’s may need to choose between attempting to win back younger audiences through menu innovation and promotions or pivoting toward lower- to middle-income households where it retains a base that competitors haven’t fully captured.

Turning insights into action

The build-your-own-bowl category is at a turning point, reshaped by shifts in income, age, and regional preferences. Brands in this space must understand not just their own performance, but how they stack up against competitors, align with synergistic brands, and compare to the category as a whole. Analyzing credit card spending data makes this possible by helping brands uncover the areas they’re gaining or losing traction in, identify which audiences and markets offer the greatest potential, and ultimately act on opportunities they may not have seen on their own.

Recommended Posts