Discover unprecedented consumer spending insights that drive growth

While traditional customer analysis provides actionable insight, they often miss the crucial link between intent and action: actual spending data. Now you can see how your top customers are using their wallets beyond your locations with insight into where they’re purchasing and how much is being spent. By following the money, you’ll gain a profound understanding of your customers’ true motivations, enabling you to make data-driven decisions that drive growth.

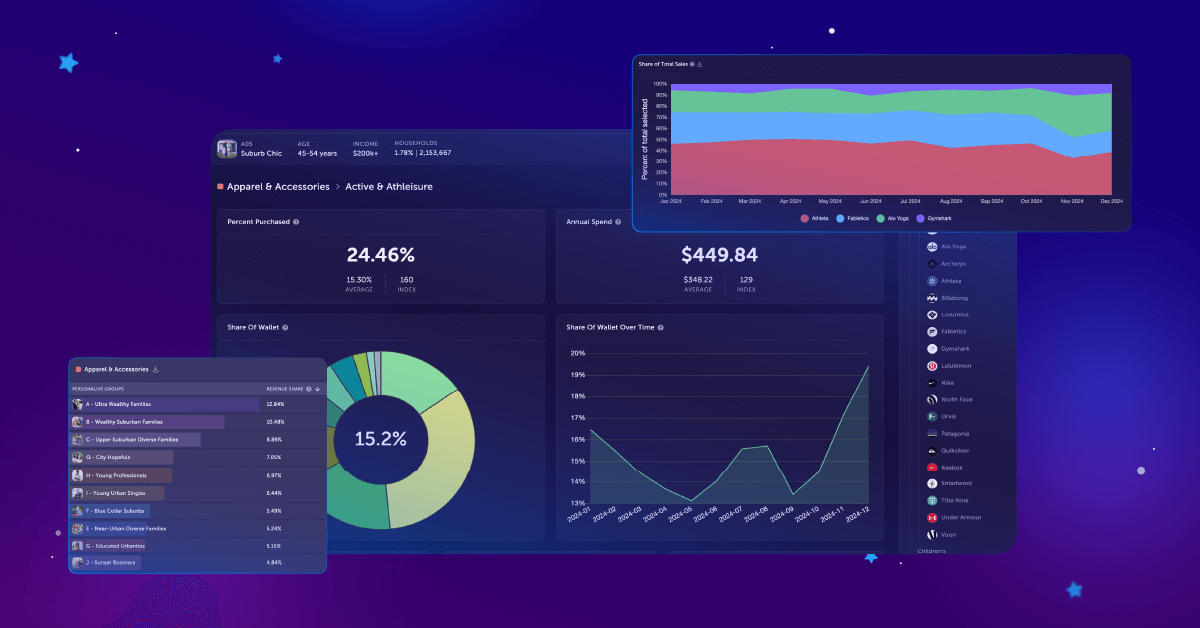

Make smarter decisions with granular consumer spending data

Access to large scale consumer spending data was long out of reach for brands. Today, with nearly $900 billion in transactions tracked from 150 million credit and debit cards, you can analyze the purchase behavior of various customer segments nationwide. This data can be broken down by specific brands or categories, various demographics and segments, and month of purchase. With this granularity of data, you can now make more informed decisions, tapping into a never-before-seen level of insight into your consumer’s spending patterns!

Here’s what will be unlocked to use in your analysis:

- Market share — See how consumer spending is distributed among specific brands within a category to identify opportunities.

- Average annual spend — Understand how much customers within different segments spend yearly at the category and brand level.

- Average ticket size — Analyze the average transaction value for deeper insight into purchase patterns.

- Purchasing frequency — Discover how often customers make purchases, helping you gauge loyalty and demand.

Discover how often customers make purchases, helping you gauge loyalty and demand.

Refine customer targeting

Diving into your customers’ social media behavior and looking at their in-store visitation patterns are great points of analysis, but often leave you making inferences based off of actions that may or may not reflect their purchasing behavior. This new era of customer insights eliminates the need for educated guessing! Customer spending data reveals actions that are truly indicative of someone’s intent to purchase, allowing more informed targeting within your brand’s marketing strategy.

Use Case:

- Step 1: Uncover high-value customer segments for your brand.

- Step 2: Pinpoint trade areas where high-spending in your brand’s category are concentrated.

- Step 3: Identify complementary brands that these consumers frequently purchase at and establish partnerships for cross-promotions or co-branded events.

- Step 4: Reach your top customers in a completely new way using the combined outreach of a multi-brand marketing effort!

Supplement your site-selection

When looking for the right area to prioritize expansion for your brand, consumer spending data can help lead you to the markets with the highest revenue potential. Once you know the segments that spend the most on your brand or within your brand’s category, you can visualize them on a map to see their population in any trade area. These insights help identify how many people are in a market, what percent will buy, and how much they will spend.

Use Case:

- Step 1: Discover your top spending segments.

- Step 2: Find where these segments are most concentrated.

- Step 3: Dig deeper into these markets with market analysis tools in our site selection platform.

- Step 4: Identify and evaluate a site that fits your brand’s criteria within the market.

Optimize competitor analysis

Understanding your competitors’ performance is crucial. Consumer spending data, allows you to dissect market share, identify key competitors in specific segments and trade areas, and analyze the spending data of your competitors customers. See which brands command the highest average annual spend and ticket prices, giving you a competitive edge.

Use Case:

- Step 1: Analyze the market share of your category between competitors within a specific region or amongst certain customer segments.

- Step 2: Identify regions or customer segments where competitors have a weaker presence or where spending is rising but not fully captured by major players.

- Step 3: Focus your expansion efforts in these areas and to implement targeted campaigns to these segments.

- Step 4: Continuously track the spending data to gauge customer response and adjust strategies to further capture market share.

Ready to see consumer spending data in action?

If you’re looking to enhance your brands pursuit of growth with the latest in customer data, SiteZeus Market is a solution used by emerging and enterprise brands alike with proven results!

Analyze and target your top customer segments with SiteZeus Market.

Recommended Posts